| 500Foods shared this story from |

Beneficial cargo owners believe that there has been an erosion of trust between service provider and customer that has left shippers shocked and angered at the failure of lines to accommodate their customers during this period of the pandemic.

European Shippers’ Council (ESC) members believe that the European authorities should be concerned about the poor service provided by the carriers who are geared to earn profits without providing a service that is fit for purpose.

“Our suggestion to the European Authorities is that they should carefully look at the current situation and take action to ensure that trade and transport flows are guaranteed under a frame of fair play rules, and not killed by the lack of service and only profit gaining,” Jordi Espin, ESC policy manager maritime transport told Container News.

“The Consortia Block Exemption Regulation (CBER) stipulates that any benefits that the carriers derive from the alliances should be returned to the market users,” he said and went on to add, “Chinese Authorities are considering a cap on freight rates since the current peak seems to be never-ending, as Rodolphe Saadé from CMA CGM said to the Financial Times some days ago.”

According to the ESC, this is not a cost matter, it is about the poor service levels that are not configured to benefit customers. One example given by Espin is for the carriers to allow shippers to use containers from carrier A to ship on carrier B’s vessel, with carrier A’s permission.

“There needs to be a solution to move containers around and provide fluidity to cargo and shipping cargo flows, the current situation is really worrying,” Espin stressed, adding, “A container is the basic brick within the maritime supply chain, without it, nothing works. Shipping lines should consider releasing pools of containers at shippers' own account to show there is good will and that cargo has top priority to reflow transport tradelanes.”

ESC believes that the shipping lines are taking advantage of the current disruption to make massive profits. Pointing to Maersk’s projected US$1 billion income for the full year, he said that the lines have no interest in improving the situation but are maintaining the reduced port calls and reduced traffic densities.

“We want strong partners to avoid any other Hanjin episode, but shipping lines should remember that they are still service companies,” Espin highlighted and went on to say, “Shippers are extremely concerned and feel outraged because there is nothing at this moment that indicates that a trust environment will soon return.”

Until there is better collaboration, shippers will not feel that trust can be restored, and that means not just looking at the available space, but the service concentration that leaves cargo stranded at ports for longer periods than expected.

“Long term contracts did not foresee a general lack of service, like the current situation where contractual obligations are not met. A contract used to frame a relationship between parties, [but it] has no meaning now. Shippers are moving into very short-term contracts or they even prefer the spot rates market, which at least offers an opportunity to choose depending on the moment,” claimed Espin.

Current trends on the Asia to Europe tradelanes are partly a consequence of the experiences of shippers in the United States with cargo being rolled over, a lack of available empty containers and spiralling rates at both US East Coast and West Coast ports.

According to some shippers in the US, the lines are targeting the high eastbound Pacific rates and concentrating all their empty containers in that high yield trade, even to the detriment of US exporters. It is important to note that the specific situation is being monitored by the Federal Maritime Commission (FMC).

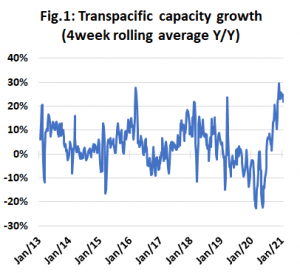

Carriers on the US trades from Asia plan to raise capacity deployment on the Transpacific, in December. Capacity which will then be four times higher than in the Asia-Europe trade, and eight times higher in January 2021.

“At this moment in time, the Transpacific market dynamics are governed by an extreme injection of capacity. In December, the Transpacific trade is expected to see a capacity increase of 27.3% year-on-year, clearly showing that the current market strength in terms of spot rates is not on account of carriers keeping Transpacific capacity artificially low,” said container shipping industry consulting company, Sea-Intelligence.

Capacity expansion on the Asia-Europe trade is more limited, however, at 6.7% growth year-on-year in December, “but it is lower than in November, and in the longer historical context, is not an exceptional increase,” added Sea-Intelligence.

The Danish consultancy also points out that spot rate developments on the Asia-Europe trade have been relatively subdued, “compared to the record-setting levels on other deep-sea trade lanes, even when considering last week’s 20% week-on-week increase.

“As a consequence of the extremely strong demand boom in the Transpacific, carriers have quite naturally diverted capacity onto the Transpacific – both to capitalise on the much higher freight rates, but of course also to be able to physically move the large volumes suddenly requiring shipment.”

Alan Murphy, CEO at Sea-Intelligence also pointed out that there is a finite number of available vessels and that “suddenly re-routing this capacity means a lower capacity growth for Asia-Europe. If we are now poised to see a similar boom in demand on Asia-Europe, shippers on that trade are about to experience very tight capacity and sharply increasing rates in the coming weeks.”

Espin is not convinced, commenting, “Current demand is not met anywhere as from the figures we have. Shipping lines, if acting according to the existing demand, would attend customer requests and allocate resources according to growing volumes, but they are not.”

Murphy argues that the lines are deploying capacity as demand requires, but he also accepts that the global market is in an “unprecedented situation,” adding that “How much capacity is deployed depends on the demand, last year there was enough capacity to service demand, compared to this year where demand is far higher.”

Worldwide Logistics, in the form of Jon Monroe, believes that shipping companies' chief executives in the US are only now waking up to the fact that their transport costs have sky-rocketed and that their cargo may not make it to their customers in a timely fashion.

“They have a hard time understanding the current situation. I don’t blame them, if I did not see this first-hand, I would have a hard time believing it,” said Monroe, “The fact that this is happening globally is a stunning wake up call to the inefficiencies of our industry. It also begs the question; should carriers be allowed to operate unsupervised?”

For Monroe, however, the problem is not merely the carriers, it is the entire supply chain mechanisms that have been put out of kilter.

Monroe explains that November cargo volumes are expected to decrease on October volumes, not because demand has fallen, but because the lack of containers in Asia is causing vessels to leave port with empty slots.

According to the US consultant, the US/Asian situation is having a knock-on effect in Europe with carriers refusing to deliver to the congested port at Felixstowe, preferring to drop United Kingdom cargo in the Dutch port in Rotterdam and Belgium’s Antwerp Port. However, with feeder services also in short supply, getting cargo to the UK market for Christmas may be a challenge.

“This container shortage is not only a carrier problem, leasing companies are out of containers and container factories in China have a four-plus month waiting period to get new containers manufactured. The entire worldwide container inventory is being stretched and out of balance,” said Monroe.

Although, carriers remain at the forefront of the difficulties created during the pandemic, as they chase higher rates in booming markets, leaving other trades inadequately supplied the shift has caused a major container imbalance, which has seen entire ships rolled in the US in an attempt to clear the backlog.

Ship operators “need to rethink the concept of blank sailings,” according to Monroe.

In Europe, Espin believes that “At this moment, they [the shipping lines] only follow a profit-oriented policy which has nothing to do with current cargo structure demand flows.”

Nick Savvides

Managing Editor

The post Breakdown in trust leaves shippers outraged at vessel operators appeared first on Container News.